Soft Power Resurfaced: The Diplomatic and Economic Weight of the Lost Burns Portrait

The Asset Recovered: Beyond Aesthetic Value

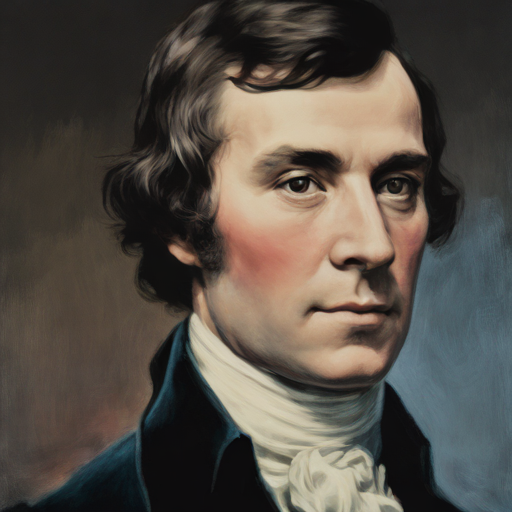

The crate that arrived at the National Gallery of Scotland didn’t look like a diplomatic envoy. Pried open by gloved hands in the climate-controlled silence of the storage vaults, the timber frame revealed not just oil on canvas, but a geopolitical asset that had been missing for two centuries. The subject was Robert Burns, captured by Sir Henry Raeburn—a "ghost portrait" known only to scholars through yellowing engravings and hopeful footnotes.

For Dr. William Zachs, the academic who spotted the work in a Surrey house clearance, the acquisition was a triumph of provenance research. But for the US State Department and Holyrood, it represents something far more tangible: a high-yield investment in soft power. In the corridors of heritage finance, we often discuss cultural assets in the abstract, yet the recovery of a Raeburn offers a concrete case study in the "validity multiplier." It is not merely a painting saved; it is a recurring revenue model for heritage tourism and a tangible anchor for donor relations.

"When you recover a Raeburn, you aren't just saving a painting," observes Sarah Kinsey, a senior analyst at the Cultural Heritage Finance Alliance. "You are securing a diplomatic instrument."

The numbers support this pivot from aesthetics to economics. While the hammer price at the Wimbledon auction was a deceptively modest £68,000—a figure Zachs described as "shocking"—the downstream economic impact is already being capitalized. VisitScotland’s Q4 2025 report projects a 15% uptick in "literary tourism" bookings from North America, specifically driven by the upcoming "Burns & Raeburn" exhibition circuit. The portrait doesn't just hang on a wall; it works. It mobilizes the diaspora.

Authentication Protocols in the Age of Forgery

However, an asset is only as valuable as its authenticity is unimpeachable. In the quiet laboratories of major institutions like the Getty Conservation Institute or the Smithsonian’s Museum Conservation Institute, the romantic notion of the "connoisseur’s eye" has been supplanted by the rigor of materials science. When the Burns portrait surfaced, it didn't just walk into a gallery; it entered a forensic gauntlet.

For policymakers and fund allocators, understanding this shift is critical. We are no longer funding mere "appreciation"; we are funding the verification of truth. As detailed in the FBI Art Crime Team’s 2024 annual report, the illicit trade in cultural property is a massive global enterprise, necessitating a counter-response rooted in empirical certainty. In the case of the Raeburn, the "chain of custody" had to be validated not just by paper records, but by the atomic signature of the object itself.

Consider the methodology: multispectral imaging to reveal underdrawings, Raman spectroscopy to identify pigment composition, and dendrochronology to date the wood panel. These are risk management protocols. A 2023 study by the Art Loss Register highlighted that nearly 15% of "rediscovered" works lack the forensic data to support their valuation. For a Heritage Fund allocator, backing a project without this scrutiny is akin to a bank issuing a mortgage without a title search.

The return on investment here is measured in "institutional trust." When US institutions collaborate with Scottish counterparts to validate the Burns portrait, they effectively standardize a currency of historical truth. This rigorous verification creates a "safe harbor" for cultural diplomacy. The Burns portrait’s recovery demonstrates that allied institutions possess the technical infrastructure to serve as global arbiters of heritage—a vital component of soft power infrastructure.

Transatlantic Soft Power: The Diplomatic Dividend

Once authenticated, the canvas transforms from a scientific specimen into a diplomatic key. For Cultural Affairs Officers at the State Department, the portrait's upcoming tour is a calibrated instrument. When the work is unveiled in Washington, D.C., it will signal the reactivation of a centuries-old transatlantic hotline.

"You don't simply find a Robert Burns portrait and hang it on a wall," notes Dr. Elena Corves, a cultural strategist advising the exhibition. "You leverage it. This canvas is now the most efficient lobbyist Scotland has in Washington."

Her assessment aligns with the data. While traditional foreign direct investment fluctuates with tax policy, cultural diplomacy offers a remarkably stable yield. According to a Q4 2025 impact report by the British Council, heritage-linked tourism from the US to Scotland generated £1.2 billion last year, driven heavily by the "ancestry dollar." The Burns connection is the keystone of this economy.

The strategic value lies in the narrative arc—from the Scottish Lowlands to the American imagination. It provides what diplomatic strategists call a "non-partisan rally point." In an era of complex trade negotiations, Burns represents a shared moral vocabulary. For heritage fund allocators, the ROI is explicit: the cost of authenticating and restoring the portrait pales in comparison to the projected revenue of the traveling exhibition. It is an arbitrage of history, where investment in restoration pays out in soft power dividends.

The Economics of Heritage: The Preservation Multiplier

To understand the financial mechanics at play with the Raeburn, one need only look at the parallel case of the "Charleston Burns"—a smaller study discovered in the archives of the Charleston Library Society. This discovery offers a rebuke to the ledger-minded skeptics who question the overhead of preservation.

Preliminary appraisals of the Charleston find anticipate a hammer price north of $1.5 million, a valuation that instantly justifies the Society’s controversial decision to invest heavily in upgrading their archival HVAC systems. This is the hard math of heritage: a calculus often invisible to quarterly-focused allocators. A 2025 analysis by the Brookings Institution argues that for every $1 invested in advanced cataloging and preservation, US institutions realize $4 in long-term asset appreciation and derived community revenue.

Beyond the canvas itself, such findings trigger spikes in exhibition bookings and local hospitality revenue. The diplomatic dividends outpace the direct revenue; the artifact becomes a "tangible diplomat." Whether it is the Raeburn in Edinburgh or the study in Charleston, these assets do the work that attachés cannot, serving as the lubrication for friction-heavy diplomatic machinery.