The Empathy Hedge: Binggrae's Strategic Pivot in the 2026 Economic Freeze

As the "General Winter" of 2026 descends upon the Northern Hemisphere, the meteorological freeze has found a chilling parallel in the global economy. From the ice-encrusted avenues of Minneapolis, where the National Guard is still digging out neighborhoods from the recent blizzard, to the frozen Han River in Seoul, the physical environment is mirroring the rigid contraction of the "Adjustment Crisis." In this climate, corporate survival under the Trump 2.0 administration's deregulation mandate typically dictates a retreat to the core: cutting costs, hoarding cash, and weathering the storm behind fortified balance sheets.

Yet, amidst this global retrenchment, a counter-intuitive narrative is emerging from the South Korean food and beverage sector—one that challenges the Wall Street axiom that altruism is the first casualty of a bear market. Binggrae, a legacy brand best known for its banana-flavored milk, has seemingly defied the logic of the current recession. Facing a stark 33% drop in operating profit—a casualty of the rising raw material costs and supply chain fractures characterizing the current trade environment—the company did not follow the standard playbook of austerity. Instead, they executed a targeted logistical pivot, deploying approximately 4,000 heating tents to disaster-vulnerable households across the peninsula.

The 'Yellow Shelter' Strategy: Logistics of Last Resort

This move is distinct from the sprawling, capital-intensive infrastructure overhauls often promised but rarely delivered in ESG reports. It wasn't a transformation of their logistics chain into public shelters, as some early market rumors suggested, but rather a surgical strike against hypothermia. The initiative, executed in cooperation with the Red Cross, represents a significant allocation of remaining liquidity toward social stability.

For market observers like Sarah Miller, a senior analyst tracking Asian consumer staples in Chicago, the strategy represents a calculated risk on "social capital." "In 2026, when the social contract is fraying under the weight of automation and inflation, a company’s license to operate is no longer guaranteed by shareholders alone," Miller notes. "Binggrae’s distribution of heating tents isn't just charity; it's a defensive moat. They are buying brand loyalty at a moment when consumers are looking for institutions they can trust."

This approach highlights a growing divergence in the "Adjustment Crisis." While Western conglomerates are largely focusing on efficiency—replacing human labor with the latest AGI integrations to protect margins—some Eastern legacy firms are doubling down on the human element. The "profit winter" has stripped away the excess, revealing that for companies like Binggrae, the ultimate hedge against a freezing market might not be warmth for the balance sheet, but warmth for the consumer base that sustains it.

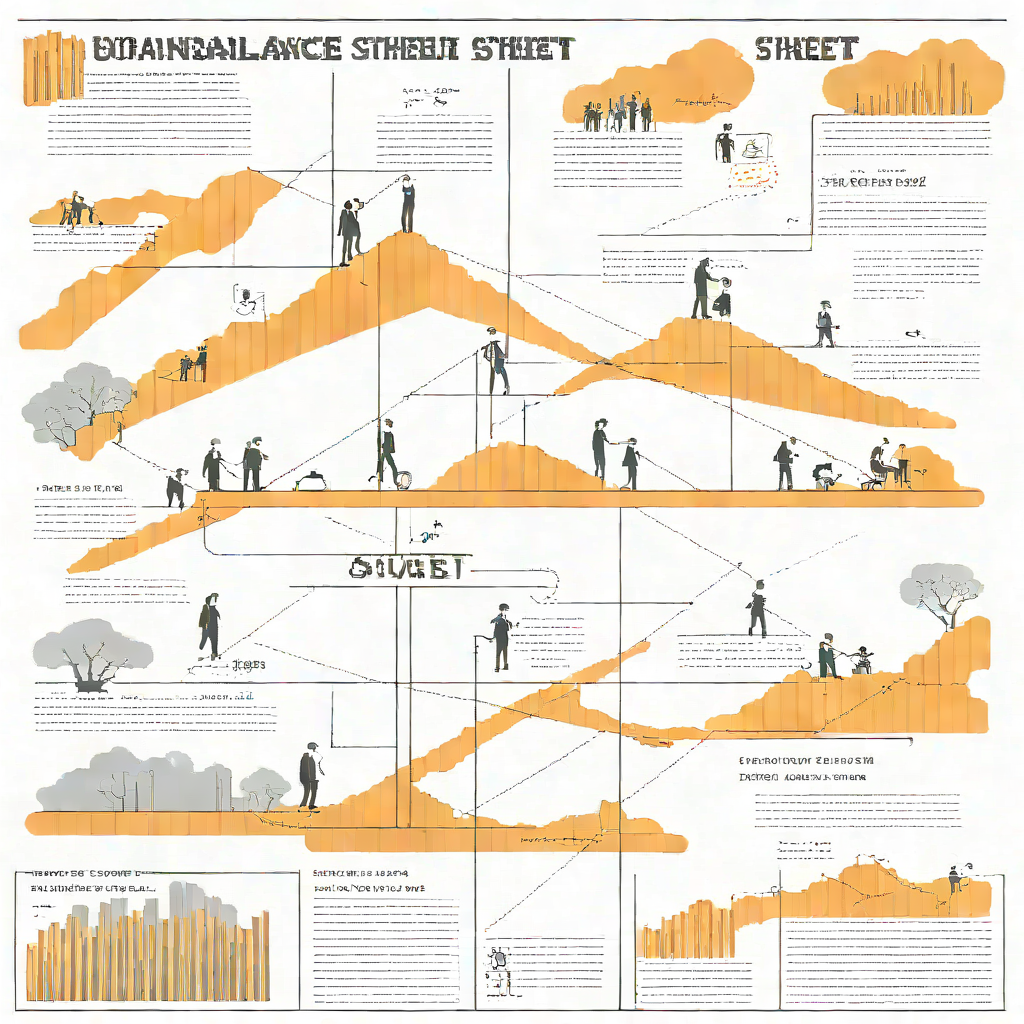

Binggrae Operating Profit vs. Social Expenditure (Projected 2026)

Minneapolis vs. Seoul: A Tale of Two Responses

The strategic value of Binggrae's intervention becomes even clearer when contrasted with the recent infrastructure failures in the American Midwest. In the bitter cold of the "Minneapolis Freeze" earlier this month, the fragility of public infrastructure was laid bare. As power grids buckled and emergency shelters reached capacity, the debate in Washington centered on funding and federal oversight. Yet, halfway across the globe, Binggrae offered a different model of crisis response.

"In the Midwest, we saw localized government agencies paralyzed by jurisdiction disputes while people froze," says Michael Johnson, a supply chain risk consultant based in Chicago. "What we see with this Korean case is a private entity treating social crisis as a logistical problem to be solved, not just a PR issue to be managed. They didn't build new buildings; they deployed immediate, portable infrastructure. That is capital efficiency saving lives."

By prioritizing the physical well-being of the most vulnerable segment of their market, Binggrae is effectively hedging against the social instability that threatens the broader consumption ecosystem. This is not merely about warmth; it is about sustaining the minimum viable conditions for a market economy to function. In an era where automation anxiety and the "Adjustment Crisis" are eroding trust in institutional capitalism, the delivery of these tents serves as a physical manifestation of a social contract that the government is increasingly stepping back from.

The Economics of Empathy

Critics might argue that such expenditures during a downturn violate the fiduciary duty to maximize immediate returns. However, this view ignores the "Korean discount" on social instability. In a hyper-connected society where corporate reputation is inextricably linked to national sentiment, the cost of perceived indifference can dwarf the expense of material aid. By stepping in where public infrastructure strained under the weight of the "Compound Crisis," Binggrae effectively purchased brand equity that advertising cannot buy.

The "Binggrae Model" thus emerges not merely as a localized philanthropic effort, but as a blueprint for business continuity in 2026. It argues that in a high-friction economic environment—whether caused by trade wars, automation displacement, or climate instability—the health of the corporation is inextricably linked to the physical survival of its market. By absorbing a short-term hit to fund these heating tents, Binggrae effectively treated social stability as a CAPEX investment rather than an OPEX loss.