Seoul's Property Paradox: The 5-Billion Won Mirage in Songpa

For an American investor accustomed to the sprawling estates of the Hamptons or the sleek glass towers of Manhattan’s Billionaires’ Row, the concept of a 900-square-foot apartment commanding $3.5 million might seem like a clerical error. Yet, in Seoul’s Songpa District, the "5 billion won" mark—approximately $3.57 million at current exchange rates—has shifted from a speculative ceiling to a concrete floor for the city’s most coveted reconstruction projects. This psychological and financial threshold, specifically for the standard 84㎡ (34-pyeong) unit, represents a staggering decoupling from the broader economic reality of the peninsula in 2026.

The recent transactions at Jamsil Le-El and the iconic Jamsil Jugong 5-danji have sent shockwaves through the global real estate community. These are not merely residential buildings; they are the front lines of a "reconstruction mania" fueled by the Yoon Suk-yeol administration’s aggressive deregulation. This local policy mirrors the pro-growth, anti-interventionist stance of the second Trump administration in Washington. As the U.S. pivots toward a high-interest, deregulated environment, South Korean capital is increasingly huddling into "safe-haven" assets. In the eyes of local investors, a derelict 1970s apartment in Jamsil is viewed with more trust than a diversified stock portfolio.

The Great Decoupling

However, this $3.5 million sticker price acts as a mirage. While headline-grabbing deals suggest a booming market, data from the Korea Real Estate Board reveals a dangerous bifurcation. While the "Reconstruction Giants" of Songpa see prices skyrocket, standard housing in the surrounding areas is stagnating or even declining in liquidity. David Chen (pseudonym), a property strategist at a global private equity firm, observes that this is a classic "concentration of capital" symptom. He notes that the barrier to entry is now so high that the market has ceased to be about housing and has become a closed-loop exchange for the ultra-wealthy. This creates a "liquidity trap" where current owners cannot find buyers outside their own narrow demographic, despite the soaring "appraisal" values.

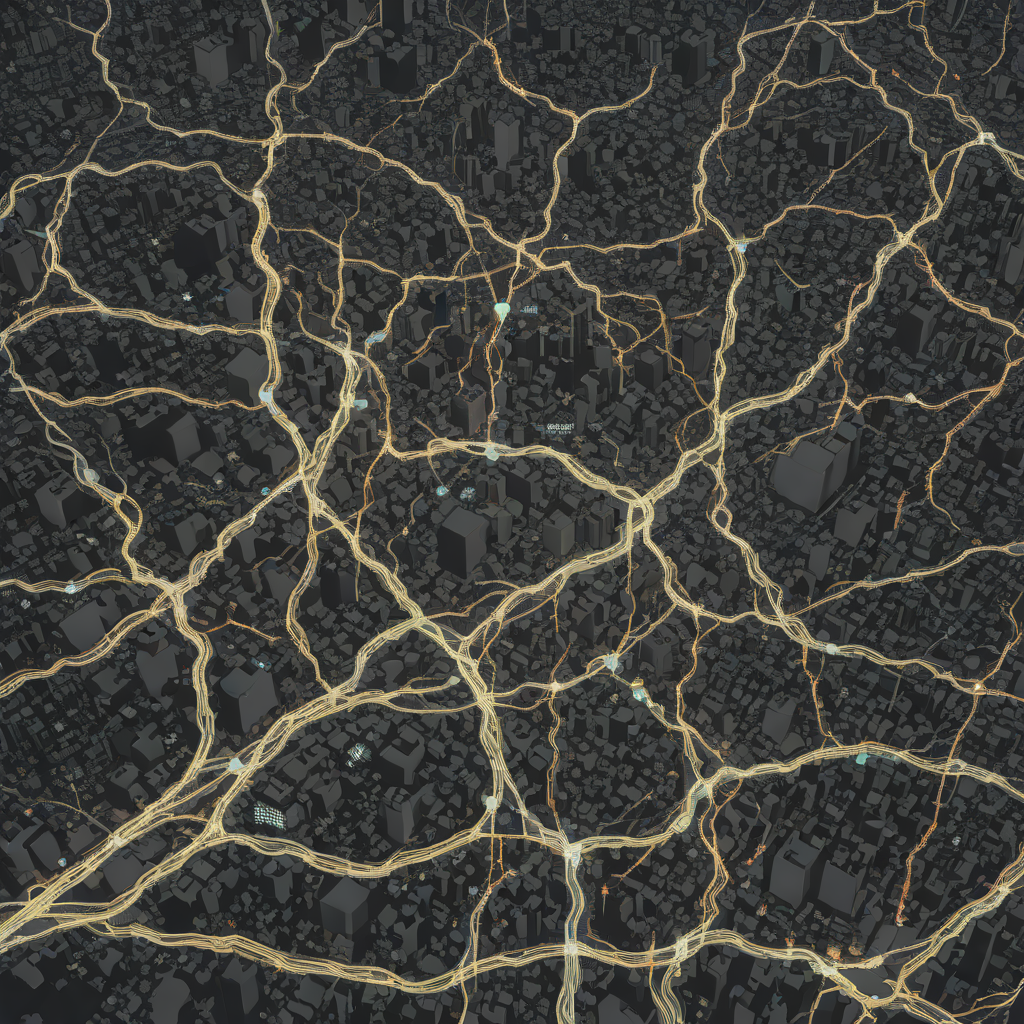

The Great Decoupling: Songpa Prime vs. Seoul Average (Source: KB Land & REB)

The implications for the free market are profound. When the "National Average" size apartment costs as much as a luxury penthouse in Chicago or a townhouse in London’s Zone 2, the social contract regarding homeownership begins to fray. The Songpa mirage suggests that as long as the government continues to ease reconstruction rules and global liquidity seeks a home, these prices can be sustained. Yet, the underlying volume of transactions tells a different story: a market that is becoming increasingly "paper-rich" but "cash-poor."

Flight to Hyper-Quality

In the high-stakes theater of Seoul’s real estate market, we are witnessing a textbook "flight to hyper-quality." This phenomenon, mirrored in the bifurcation of Manhattan’s luxury residential sector versus its hollowed-out commercial real estate, suggests that in the volatile economic climate of early 2026, capital is no longer seeking growth; it is seeking a fortress.

The 5-billion won transaction at Jamsil Jugong 5 is not a purchase of a living space; it is a purchase of a future derivative—the reconstruction rights. Investors are betting that the current deregulatory wave, emboldened by the global shift toward "build-baby-build" policies seen in the Trump 2.0 administration, will finally unlock these stagnant assets. Meanwhile, just blocks away, standard apartment complexes—those without immediate reconstruction prospects—are seeing liquidity evaporate.

Michael Johnson (pseudonym), a senior analyst at a risk management firm monitoring Asian asset classes, notes the danger. "We are seeing a market that looks healthy at the top 1% but is fundamentally seizing up at the median," Johnson states. He highlights that while landmark reconstruction projects have seen price resilience, the transaction volume for standard units in the same district has plummeted. Sellers of mid-tier apartments are finding themselves in a liquidity trap, unable to offload assets as buyers exclusively chase the "blue chip" reconstruction candidates that promise a hedge against the inflation reignited by recent trade protectionism measures.

The Songpa Decoupling: Reconstruction vs. Standard Price Index (2025-2026)

The Silent Volume Crisis

To the casual observer walking past the gleaming real estate offices of Jamsil, the numbers in the windows tell a story of unbridled prosperity. Yet, step inside one of these brokerages, and the atmosphere is not one of frenzy, but of a stifling, anxious quiet. This is the "Silent Volume Crisis" of 2026—a phenomenon where asset values skyrocket on paper, but the actual mechanism of the market, the exchange of hands, has all but seized up.

Data from the Korea Real Estate Board (REB) paints a stark picture. While benchmark asking prices in Songpa-gu have climbed nearly 12% over the last fiscal year, transaction volumes have plummeted to levels not seen since the global financial contraction of 2008. The market has effectively bifurcated: a "museum tier" of trophy assets that serve as wealth signaling but rarely trade, and a paralyzed functional market where genuine buyers are priced out by interest rates that have remained stubbornly high due to the ripple effects of American protectionist policies.

A Global Phenomenon?

This phenomenon is not a unique Korean pathology. Rather, it is the latest manifestation of a synchronized global fracturing that has come to define the real estate landscape of 2026. From Manhattan to London, the post-pandemic recovery has curdled into a distinct "K-shaped" stagnation. In New York, this bifurcation has reached levels reminiscent of the Gilded Age, accelerated by the Trump administration’s aggressive deregulation of capital gains and foreign investment channels. While the administration’s "America First" economic policies have sparked a sugar high in equities, the housing market tells a more complex story of hollowed-out liquidity.

Economists argue this trend represents a dangerous distortion of market signals. When a 5-billion won transaction in Seoul or a $75 million penthouse sale in New York becomes the headline, it creates a "wealth mirage." It suggests a robustness that simply does not exist for 99% of participants. The risk for investors in 2026 is mistaking the resilience of the luxury sector for the health of the entire ecosystem.